We Are The Best Digital Agency For Business

Choose “ITUPDOWN” as your digital marketing agency and

propel your business to new heights with our services

digital marketing materials and our proprietary technology platform.

Our business is to provide strategic digital solutions.

our creation, Since we have developed more than 100 websites

that allow brands to connect with their audience in a way

relevant and meaningful.

All The Great Things We've Done

They're Talking About Us

Core Services

Smart digital marketing includes many sub-services. Our main goal is to choose the most

efficient and get the best result.

LOCAL SEO

WEBSITE DESIGN

WEBSITE DEVELOPMENT

Technical SEO

CONTENT WRITING

WEBSITE AUDIT

Ecommerce Website Development

GOOGLE ADS

SOCIAL MEDIA MARKETING

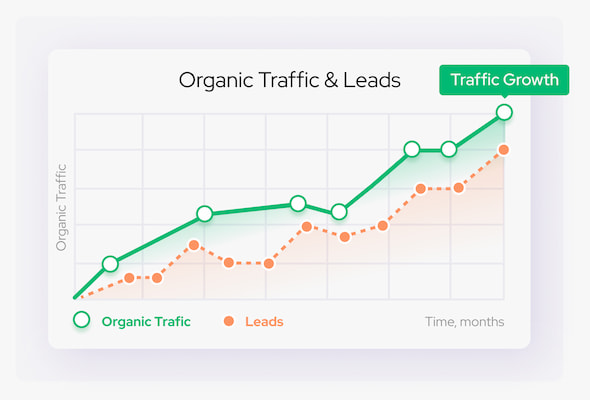

About Search Engine Optimization

Why Start?

What is SEO?

Quality and Robust Online Reseller Services

How Much SEO Services?

amount of keywords, age & quality of the website

Of course, you can hire a specialist and pay him a salary of about 500 – 100$ to do the entire project, but he will never be able to physically & mentally provide you the same amount of works as an SEO company.

Why Our SEO Company?

Our website holds the top-3 position for all popular keywords in the niche.

More than 50+ websites on the 1st-page of organic search results

Half Payment in Advance

100% Guarantee

Online Reporting 24/7

Eleven Years of Experience

Dedicated Account Manager

Our Team

Samy- Digital Marketing

Muhammad - Developer

Experienced software developer with 3+ years of experience in the industry. Proven ability to design, develop, and deliver high-quality software solutions.